Archive for September, 2008

I stumbled on this amazing article on how to

This article was not written by me or anyone at BTP. I’m just providing the link. And one last helpful tip: keep a “master magnet” glued to a piece of board or what-not. This is your polarity for all host points and will assure that everything you do, for any army, for any model, has consistent polarity on the magnets.

This is mount Timpanogas. It is located directly North of where I live and it towers over the valley, an ageless compass point.

If I belaboured you with the details of this day, you would slip into a catatonic state most likely. I really don’t think you’ll be interested.

But that never stopped me before!

Yesterday, I got home early, packed up all three kids in the car and headed out to Macey’s. They’re closed on Sundays, so it’s always really busy on Saturday night. It’s really magical, almost like the whole city is down there. Like a town market where I can brush elbows with the locals.

I couldn’t find the kids shoes, so they just went barefoot. I remember being young– I don’t think I even wore shoes all summer long. There was a dirt road in front of our house, and I would walk up and down it at the beginning of summer to toughen up my feet.

Anyway, we got groceries and some soft serve ice cream and headed back home.

Today was even less eventful. I went for a walk around the block by myself this morning, but no breakthroughs, no insights, just the normal chatter of chaos that goes on in my mind; a stew of worry and fantasy.

Then off to church, which started well, but ended of course with Griffin wailing and squirming. My wife took off after sacrament meeting to go visit her sister in Salt Lake (her nephew had appendicitis so she’s going up to help). Griffin was in an odd temper and wouldn’t go to his class. I think I got him worked up in the foyer keeping him sitting next to me. I can’t help but wonder if maybe I should just let him run around like a madman outside half the time.

This left me with the kids for this entire afternoon, a delight, to say the least. We made chicken dinosaurs in the microwave for lunch and mashed potatoes and vegetables for dinner. I absolutely love to spend time with the kids. Their clear eyes and enthusiasm make life 50% happier.

I also got to spend part of the day preparing for the upcoming D&D adventure. It’s going to be a blast. I got the new Adventurer’s gear book, which is an invaluable resource, chock full of magic items. A lot of them are quite ingenious.

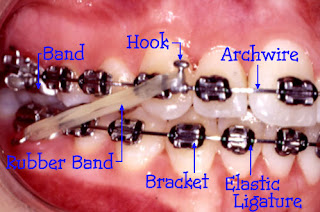

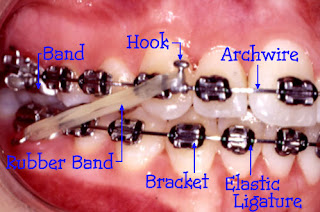

When I had my braces on, I asked the orthodontist if he could just tighten the braces up to the maximum level straitaway and get it all over with. He said that would do irreparable damage to my teeth, that the adjustment had to be gradual so the teeth could adjust.

The adjustments are painful, but after a few days the discomfort goes away and I’m one step closer to beautiful, white, straight teeth. It’s just a matter of patience through the years.

This is how it has been with my soul. I am impatient. I thought that coming up on 40 years old I would be more “finished” but not so much. I am excited for this coming week, to continue on my spiritual quest; to be more faithful in the simple things.

Media is a big part of it. I need to get a better diet going. Like a missionary has– uplifting music, audio books, conference, scriptures and so forth. I am very optimistic, though I am in a slight dip right now, it is still higher than the previous dip. Like a wavy line slowly going upwards.

Onward and upwards!

Finding Peace

This little jewel blew my mind, too.

Picture:

Ork Trukk. See some more pics of the Gritty Orks prototypes.

At this particular moment I am watching Stargate Atlantis. The kids have just gone to bed, which means there are strange animal noises and thumping sounds coming from the various rooms. Ha! Let them have their fun. I am drinking some milk with ice cubes in it. Frosty.

I am still booking projects for October. There are about four slots left for the last week, so I’m in the home stretch. If those are filled up by this coming Tuesday I’ll be ever so happy. It’s fun to set a hard goal then work hard to achieve it!

I sincerely thank everyone that has made an inquiry.

Also still trying to sell off the Lions Rampant. Hum. Not so much that I want to get rid of them, really, they’ve been a lot of fun. Details were about two entries ago.

What’s next? Probably Orks or perhaps that biker fast attack army I’ve got in that case. Sweet. The question is should I do them traditional White Scars OR make up my own chapter (the Red Dragons?). I think that with the Angry Goats, using the beastmen heads as metal masks, I think I might do the same thing with lizardmen heads. Something like that. The problem is that the crazier an army is, the less sale-able it is down the road.

Holy cow, I haven’t updated the blog for like five days.

What else? This afternoon was a slow day down at the studio, just me and Joseph. We worked on some different techniques to do yellow armor. We made some good progress.

A random note about the blog: this and the youtube channel both have many thousands of active subscribers. To me it is a miracle, and I am humbled and grateful. I think it’s a delightful and unexpected phenomenon. I realized some months ago that I couldn’t please everyone. So, basically I just post what I post and hope people like it.

We’ve starting doing a “morning show”. I had great fun taping and editing it. It’s worth a look.

My only concern right now is getting projects set up for October.

I am ready to help you in any matter. If you tell me what you’re after and a rough budget, I can help get the cost down.

I have a lot of good ideas for themed armies that are often very inexpensive. I have a lot of knowledge and resources.

I am also resurrecting an old special for the month of October: Hungry, Evil, or Dead Give us Artistic License for a Tyranids, Necrons, Chaos Daemons or Vampire Counts and get 25% off on Painting and cost of Materials. In the case of Chaos Daemons it needs to be a themed army of mostly one chaos god.

PS- here’s a cute pic of Shadowsun:

Most of you are familiar with my journey of political awakening. I am just a regular guy trying to figure it out.

Here’s a site I’ve found very useful to get information about legislation and your representatives. So, now is the time to call, write and get involved.

I often feel like I am griping over nothing. After all, I have it pretty good. Maybe I should just shut up and like it. Not likely! I’m going to push forward.

Letter from Ron Paul about the “Mother of All Bailouts”

Dear Friends:

The financial meltdown the economists of the Austrian School predicted has arrived.

We are in this crisis because of an excess of artificially created credit at the hands of the Federal Reserve System. The solution being proposed? More artificial credit by the Federal Reserve. No liquidation of bad debt and malinvestment is to be allowed. By doing more of the same, we will only continue and intensify the distortions in our economy – all the capital misallocation, all the malinvestment – and prevent the market’s attempt to re-establish rational pricing of houses and other assets.

Last night the president addressed the nation about the financial crisis. There is no point in going through his remarks line by line, since I’d only be repeating what I’ve been saying over and over – not just for the past several days, but for years and even decades.

Still, at least a few observations are necessary.The president assures us that his administration “is working with Congress to address the root cause behind much of the instability in our markets.” Care to take a guess at whether the Federal Reserve and its money creation spree were even mentioned?

We are told that “low interest rates” led to excessive borrowing, but we are not told how these low interest rates came about. They were a deliberate policy of the Federal Reserve. As always, artificially low interest rates distort the market. Entrepreneurs engage in malinvestments – investments that do not make sense in light of current resource availability, that occur in more temporally remote stages of the capital structure than the pattern of consumer demand can support, and that would not have been made at all if the interest rate had been permitted to tell the truth instead of being toyed with by the Fed.

Not a word about any of that, of course, because Americans might then discover how the great wise men in Washington caused this great debacle. Better to keep scapegoating the mortgage industry or “wildcat capitalism” (as if we actually have a pure free market!).

Speaking about Fannie Mae and Freddie Mac, the president said: “Because these companies were chartered by Congress, many believed they were guaranteed by the federal government. This allowed them to borrow enormous sums of money, fuel the market for questionable investments, and put our financial system at risk.”

Doesn’t that prove the foolishness of chartering Fannie and Freddie in the first place? Doesn’t that suggest that maybe, just maybe, government may have contributed to this mess? And of course, by bailing out Fannie and Freddie, hasn’t the federal government shown that the “many” who “believed they were guaranteed by the federal government” were in fact correct?

Then come the scare tactics. If we don’t give dictatorial powers to the Treasury Secretary “the stock market would drop even more, which would reduce the value of your retirement account. The value of your home could plummet.” Left unsaid, naturally, is that with the bailout and all the money and credit that must be produced out of thin air to fund it, the value of your retirement account will drop anyway, because the value of the dollar will suffer a precipitous decline. As for home prices, they are obviously much too high, and supply and demand cannot equilibrate if government insists on propping them up.

It’s the same destructive strategy that government tried during the Great Depression: prop up prices at all costs. The Depression went on for over a decade. On the other hand, when liquidation was allowed to occur in the equally devastating downturn of 1921, the economy recovered within less than a year.

The president also tells us that Senators McCain and Obama will join him at the White House today in order to figure out how to get the bipartisan bailout passed. The two senators would do their country much more good if they stayed on the campaign trail debating who the bigger celebrity is, or whatever it is that occupies their attention these days.

F.A. Hayek won the Nobel Prize for showing how central banks’ manipulation of interest rates creates the boom-bust cycle with which we are sadly familiar. In 1932, in the depths of the Great Depression, he described the foolish policies being pursued in his day – and which are being proposed, just as destructively, in our own:

Instead of furthering the inevitable liquidation of the maladjustments brought about by the boom during the last three years, all conceivable means have been used to prevent that readjustment from taking place; and one of these means, which has been repeatedly tried though without success, from the earliest to the most recent stages of depression, has been this deliberate policy of credit expansion.

To combat the depression by a forced credit expansion is to attempt to cure the evil by the very means which brought it about; because we are suffering from a misdirection of production, we want to create further misdirection – a procedure that can only lead to a much more severe crisis as soon as the credit expansion comes to an end… It is probably to this experiment, together with the attempts to prevent liquidation once the crisis had come, that we owe the exceptional severity and duration of the depression.

The only thing we learn from history, I am afraid, is that we do not learn from history.The very people who have spent the past several years assuring us that the economy is fundamentally sound, and who themselves foolishly cheered the extension of all these novel kinds of mortgages, are the ones who now claim to be the experts who will restore prosperity! Just how spectacularly wrong, how utterly without a clue, does someone have to be before his expert status is called into question?Oh, and did you notice that the bailout is now being called a “rescue plan”? I guess “bailout” wasn’t sitting too well with the American people.

The very people who with somber faces tell us of their deep concern for the spread of democracy around the world are the ones most insistent on forcing a bill through Congress that the American people overwhelmingly oppose.

The very fact that some of you seem to think you’re supposed to have a voice in all this actually seems to annoy them.I continue to urge you to contact your representatives and give them a piece of your mind. I myself am doing everything I can to promote the correct point of view on the crisis. Be sure also to educate yourselves on these subjects – the Campaign for Liberty blog is an excellent place to start. Read the posts, ask questions in the comment section, and learn.H.G. Wells once said that civilization was in a race between education and catastrophe. Let us learn the truth and spread it as far and wide as our circumstances allow. For the truth is the greatest weapon we have.

I’m selling the studio Lions Rampant army. It is 3000- 3500 points.

Cost is $1859.

That includes shipping in the US.

Overseas is $16 more.

Constists of:

72x infantry as follows–

33x lasgun

3x lascannon

3x autocannon

3x missile launcher

4x plasma rifle

7x grenade launcher

7x meltagun

4x flamers

1x commissar in carapace armor

3x converted officers

4x storm trooper sergeants

3x sentinels

1x leman russ vanquisher

1x leman russ demolisher

2x baneblade

1x hellhound

3x basilisk

4x chimera

The Austrian School asserts that inflation is an increase in the money supply, rising prices are merely consequences and this semantic difference is important in defining inflation[17]. Ludwig von Mises, the seminal scholar of the Austrian School, asserts that:

Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term `inflation’ to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation. . . . As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are in fact only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of the evil. They try to keep prices low while firmly committed to a policy of increasing the quantity of money that must necessarily make them soar. As long as this terminological confusion is not entirely wiped out, there cannot be any question of stopping inflation (Emphasis added).[18]

Following their definition, Austrian economists measure the inflation by calculating the growth of what they call ‘the true money supply’, i.e. how many new units of money that are available for immediate use in exchange, that have been created over time.[19][20][21]

This interpretation of inflation implies that inflation is always a distinct action taken by the central government or its central bank, which permits or allows an increase in the money supply.[22] In addition to state-induced monetary expansion, the Austrian School also maintains that the effects of increasing the money supply are magnified by credit expansion, as a result of the fractional-reserve banking system employed in most economic and financial systems in the world.[23]

Austrians claim that the state uses inflation as one of the three means by which it can fund its activities, the other two being taxing and borrowing.[24] Therefore, they often seek to identify the reasons for why the state needs to create new money and what the new money is used for.

Various forms of military spending is often cited as a reason for resorting to inflation and borrowing, as this can be a short term way of acquiring marketable resources and is often favored by desperate, indebted governments.[25] In other cases, the central bank may try avoid or defer the widespread bankruptcies and insolvencies which cause economic recessions or depressions by artificially trying to “stimulate” the economy through “encouraging” money supply growth and further borrowing via artificially low interest rates.[26]

Wednesday, September 24, 2008

Dear Friends,

Whenever a Great Bipartisan Consensus is announced, and a compliant media assures everyone that the wondrous actions of our wise leaders are being taken for our own good, you can know with absolute certainty that disaster is about to strike.The events of the past week are no exception.

The bailout package that is about to be rammed down Congress’ throat is not just economically foolish. It is downright sinister. It makes a mockery of our Constitution, which our leaders should never again bother pretending is still in effect. It promises the American people a never-ending nightmare of ever-greater debt liabilities they will have to shoulder. Two weeks ago, financial analyst Jim Rogers said the bailout of Fannie Mae and Freddie Mac made America more communist than China! “This is welfare for the rich,” he said. “This is socialism for the rich. It’s bailing out the financiers, the banks, the Wall Streeters.”That describes the current bailout package to a T.

And we’re being told it’s unavoidable.

The claim that the market caused all this is so staggeringly foolish that only politicians and the media could pretend to believe it. But that has become the conventional wisdom, with the desired result that those responsible for the credit bubble and its predictable consequences – predictable, that is, to those who understand sound, Austrian economics – are being let off the hook. The Federal Reserve System is actually positioning itself as the savior, rather than the culprit, in this mess!

• The Treasury Secretary is authorized to purchase up to $700 billion in mortgage-related assets at any one time. That means $700 billion is only the very beginning of what will hit us.• Financial institutions are “designated as financial agents of the Government.” This is the New Deal to end all New Deals.•

Then there’s this: “Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.” Translation: the Secretary can buy up whatever junk debt he wants to, burden the American people with it, and be subject to no one in the process.

There goes your country.

Even some so-called free-market economists are calling all this “sadly necessary.” Sad, yes. Necessary? Don’t make me laugh.Our one-party system is complicit in yet another crime against the American people. The two major party candidates for president themselves initially indicated their strong support for bailouts of this kind – another example of the big choice we’re supposedly presented with this November: yes or yes.

Now, with a backlash brewing, they’re not quite sure what their views are. A sad display, really.Although the present bailout package is almost certainly not the end of the political atrocities we’ll witness in connection with the crisis, time is short. Congress may vote as soon as tomorrow. With a Rasmussen poll finding support for the bailout at an anemic seven percent, some members of Congress are afraid to vote for it. Call them! Let them hear from you! Tell them you will never vote for anyone who supports this atrocity.

The issue boils down to this: do we care about freedom? Do we care about responsibility and accountability? Do we care that our government and media have been bought and paid for? Do we care that average Americans are about to be looted in order to subsidize the fattest of cats on Wall Street and in government? Do we care? When the chips are down, will we stand up and fight, even if it means standing up against every stripe of fashionable opinion in politics and the media?

Times like these have a way of telling us what kind of a people we are, and what kind of country we shall be.

In liberty,

Ron Paul